The finance and technology sector continues to evolve, adopting fintech trends that are shaping the financial world. 2025 will be no exception, with many anticipating the fintech space multiplying in folds to reach $174 billion.

The banking industry is becoming more tech-savvy by adopting fintech solutions. Trends like embedded finance, blockchain, and more continue to shape the industry every unfolding year.

Let’s explore these top five fintech trends poised to revolutionize the industry. They offer businesses and consumers unprecedented opportunities and conveniences.

1. Embedded Finance

Embedded finance is one of the fintech trends molding the banking industry. It involves integrating services or financial tools within financial and non-financial institutions.

This financing model covers services like making payments within social media apps and accessing loans through non-traditional channels. It also involves integrating financial services into e-commerce platforms and many more.

Besides, embedded finance is expanding its reach and accessibility through buy now pay later (BNLP). The BNLP payment option enables buyers to purchase and pay for goods later. In most cases, the payment is usually split in installments to be paid over time.

According to the Ascent survey, millennials and Gen Zs are enthusiasts of BNLP. A good percentage of the group are early adopters, and this is criticized as the cause of youth debts.

However, the booming trends don’t show signs of backing down. Block (formerly Square) struck a deal with Afterpay to own the Australian BNLP platform for $29 billion. It’s also projected that $576 billion worth of transactions will be made courtesy of the BNLP option by 2026.

So, the earlier you incorporate the buy now, pay later payment option in your business, the better.

2. SaaS

SaaS, better known as software as a service, is another fintech trend worth watching. Reports indicate the SaaS sector is headed in the right direction and is expected to hit the $623 billion milestone by 2023 at an 18% compound annual growth rate.

Companies that incorporate SaaS services enjoy many benefits. They can access and pay for various software applications hosted in the cloud without installing them on their computers or servers.

With such benefits, companies can cut overhead costs. This also allows many organizations to focus resources only on improving customer experiences, which is the most important.

In addition, SaaS services provide access to several powerful tools, enhancing security protocols ideal for data management and storage. In most cases, these security protocols would be expensive for companies to implement independently.

3. AI & Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) undoubtedly shape fintech’s future.

The technologies enable fraud detection, predictive analysis, and personalized financial recommendations. This makes banking more secure, efficient, and tailored to customers’ needs.

In 2025, Fintech companies can leverage AI and ML technologies to automate fraud detection or loan origination and provide accurate insights into customers’ behavior. This way, businesses reduce costs associated with manual labor and increase overall performance and efficiency.

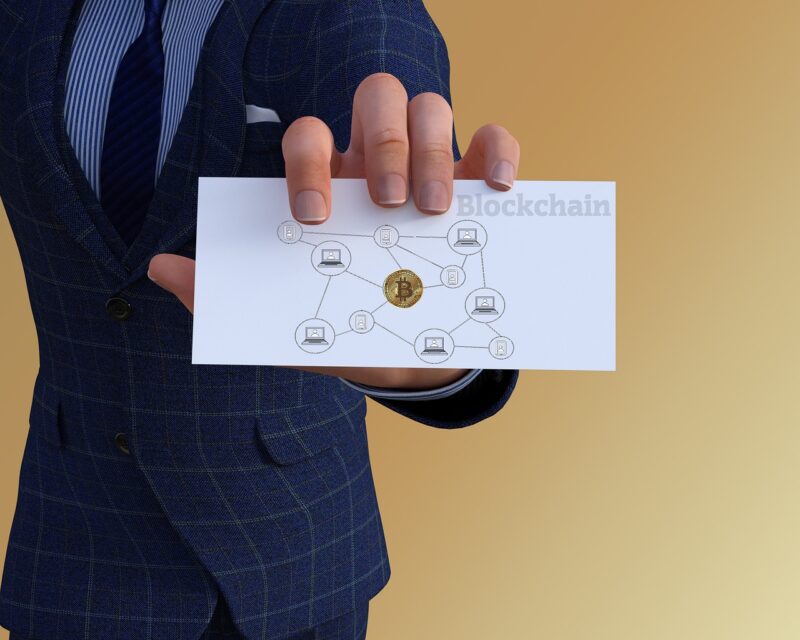

4. Blockchain

Of all the fascinating trends in fintech, blockchain tops the list as a rapidly evolving technology. Blockchain technology is a digital ledger that records and verifies various types of transactions.

The digital ledger allows machines, individuals, and organizations to securely transfer digital assets without relying on third-party intermediaries. Decentralization makes the technology efficient for various financial applications, such as transfers, payments, and trading.

Besides being secure, blockchain technology prides itself on cost savings because of its distributed nature. So, instead of costly intermediaries like brokers or banks, the technology reduces costs related to international financial transactions.

Also, having all its transactions stored on an immutable public ledger means the technology is transparent, increasing trust in financial systems by reducing delays in payment settlements and fraud.

5. Alternative Financing

The aftermath of the COVID-19 virus has left a mark on every corner of the earth. Both six-dollar businesses and startups have a share of the pandemic impact.

Though 79% of bank lenders claim in a survey that they do not reduce capital for supporting trade, there’s a wide gap in global trade finance. This is a key sector where alternative financing plays a major role.

Alternative financing is known as business funding given by non-bank institutions. Know that some of the funding is usually not a loan sometimes.

For example, revenue-based financing (RBF) is usually non-loan funding. However, RBF is repaid on most occasions as a percentage of the total business revenue per month as per the agreement. Another type of alternative financing, invoice factoring, is where outstanding business invoices are sold at a discount for immediate cash.

Though these practices have existed for some time, they have become more popular recently due to e-commerce and the startup boom.

The alternative financing sector has a promising future as fintech firms incorporate the trend into their daily operations. It is valued at $6.62 billion and is expected to grow at a CAGR of 6.3% from 2022 to 2028.

Wrapping Up

Fintech continues to be a driving force for the future of the banking industry. By 2025, the fintech trends will redefine how we manage, invest, and interact with our finances.

The known trends are greater use of blockchain, embedded finance, and AI & Machine learning. As a result, users will easily access tailored services that satisfy their needs.

But, companies must stay alert to the technological innovations shaping the finance industry to stay competitive.